Be sure to know all the basics before our interview with Dr. Luy tomorrow!

Two types of money sources discussed here: taxes (can be general or selective), and bonds (government borrows money to pay for things).

Types of taxes:

- General taxes

- Property taxes

- Real property

- Land

- Buildings

- Etc.

- Personal property

- Vehicles

- Stocks/bonds

- Patents

- Etc.

- Real property

- Sales Taxes

- Regressive by nature (property taxes are as well!)

- Can be used to fund specific projects

- Property taxes

- Selective Taxes

- Tourist taxes

- Hotels, car rental, etc.

- Sin taxes

- Alcohol, cigarettes, lotteries, etc.

- Many states have lotteries can be used to fund all kinds of things

- Except Hawaii and Utah!

- Jersey tax

- No one has actually gotten this through a legislature yet though

- Tourist taxes

- Income Tax

- It is actually legal to impose state tax on business done within the state, including sports games!

- Game-Day Surcharges

- Primarily additional cost to tickets and parking at events

Debt Financing: many ways to make the money move.

- Three vital principles for using debt to make things happen:

- Use more time to make the tax burden less onerous

- Use more time to make the financial pain smaller and get the rewards up front, for politics

- Use more time so that the beneficiaries are paying (people who leave or come are paying for what they have access to).

- Note that the debt should still only reach out to the expected end of usefulness of the product, or else you’re paying money for nothing on the back end.

Bonds!

- Straight serial method

- Paying more up front, interest decreases to end

- Graduated serial method

- Paying less up front, more total interest

Bond rating is mentioned, including S&P rating. Ahh memories. I wonder if the USA’s credit score is back up to AAA.

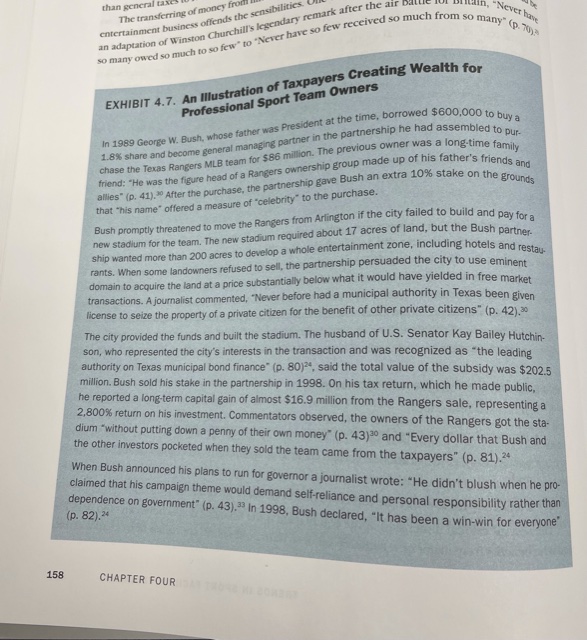

Tax-exempt bonds can only be issues by governments. In 1986 the Tax Reform Act was passed to try and prevent cities from using tax-exempt bonds to pay for stadiums but there were loopholes (of course) and things got messier.

Some blast from the past of sport marketing! Specifically w/r/t getting a new bond passed.

- Market segmentation: different groups behave differently and have different priorities

- Benefit principle: sell based on desire

- Development of a strategic plan: campaign before the referendum to create the best chance for success

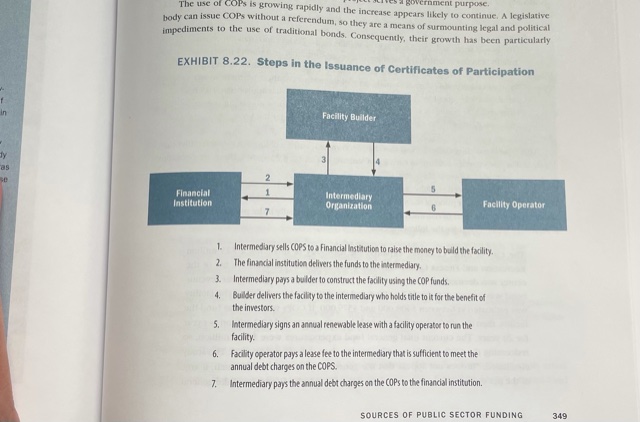

Bonds are guaranteed debt. There are also non-guaranteed debt instruments:

- Revenue bond

- Paid specifically from revenues generated by facility

- Certificate of participation

- Public trust model

- A nonprofit or other org acts on behalf of the government entity

- Public-private partnership model

- The local government itself behaves as the intermediary

- Public trust model

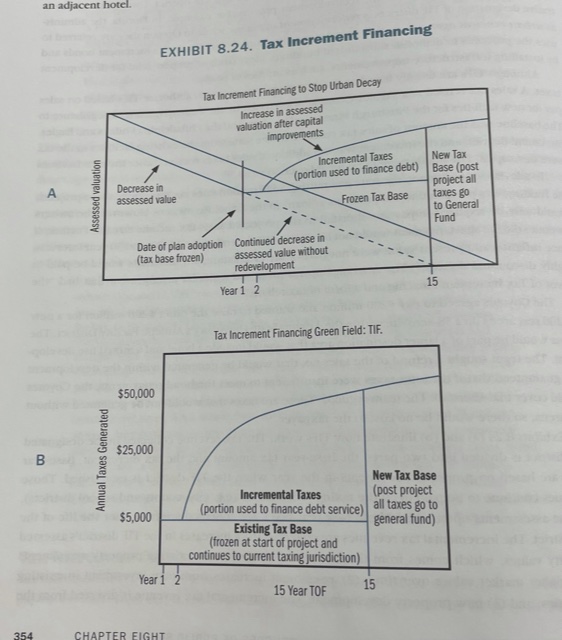

- Tax-Increment Financing Bonds

- Paid for by the increase in property values and resulting increase in property taxes

- Super attractive, but be suspicious, people will eagerly assume it can’t fail

- Paid for by the increase in property values and resulting increase in property taxes

- Asset-Backed Securities

- Securitization

- Selling future revenue streams to investors

- Player sale-and-leaseback arrangement

- European football instrument for trying to get more money

- Securitization